NFRS for SME

Background

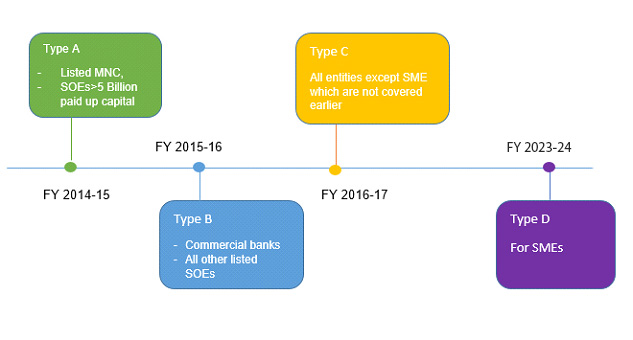

Nepal Financial Reporting Standards (NFRS) have been made applicable to Small and Medium sized Entities (SMEs). Accounting Standards Board, Nepal has approved the Nepal Financial Reporting Standard for Small and Medium-sized Entities (NFRS for SMEs) 2017 on 12 April 2017 (2073 Chaitra 30) and sent it to the Institute of Chartered Accountants of Nepal (ICAN) on 13 April 2017 for the pronouncement. Subsequently the ICAN has pronounced the NFRS for SMEs effective from 2076 Shrawan 1 (17 July 2019).

However, as per latest notice published by ICAN on 25 July 2021 (2078 Shrawan 10), mandatory effective date of NFRS for SMEs has been extended and applicable from 1 Shrawan 2080 (17 July 2023) onwards i.e from FY 2080-81 (FY 2023-24). Though adoption of NFRS for SMEs on voluntary basis before such mandatory effective date is recommended from ICAN.

Applicability

The NFRS for SMEs is intended for use by small and medium-sized entities (SMEs). Small and medium-sized entities are entities that:

- Do not have public accountability; and

- Publish general purpose financial statements for external users

| Public Accountability | |

| Borrowings from banks or financial institutions or public funds or from entities holding assets in fiduciary capacity |

NRs 500 million or more |

| Balance Sheet total (without off-setting current liabilities with current assets |

NRs 1,000 million or more |

| employees including workers in an average |

More than 300 |

| Annual Turnover | NRs 1,000 million or more |

| Holding assets in fiduciary capacity |

includes security brokers handling demat account, micro finance and cooperatives) |

| About Micro Entities | ||

| Annual Turnover | NRs 100 million or less | |

| Borrowings from banks or financial institutions or public funds or from entities holding assets in fiduciary capacity |

NRs 1,000 million or more | |

| Balance Sheet | NRs 100 million (without off-setting current liabilities in current assets) or less |

|

| Holding assets in fiduciary capacity (includes security brokers handling demat account, micro finance and cooperatives |

NRs 50 million or less | |

| An entity must meet all of the above thresholds in 2 consecutive years to qualify as a micro-entity and once qualified, must exceed at least 1 of the above thresholds for 2 consecutive years to cease to qualify | ||